It is no exaggeration to say that retail has changed like never before.

For some time, operations have been growing increasingly more complex, and shoppers increasingly more discerning. Now that evolution has been accelerated. Retailers must be flexible in meeting consumer demands in the face of a rapidly changing retail landscape if they hope to succeed.

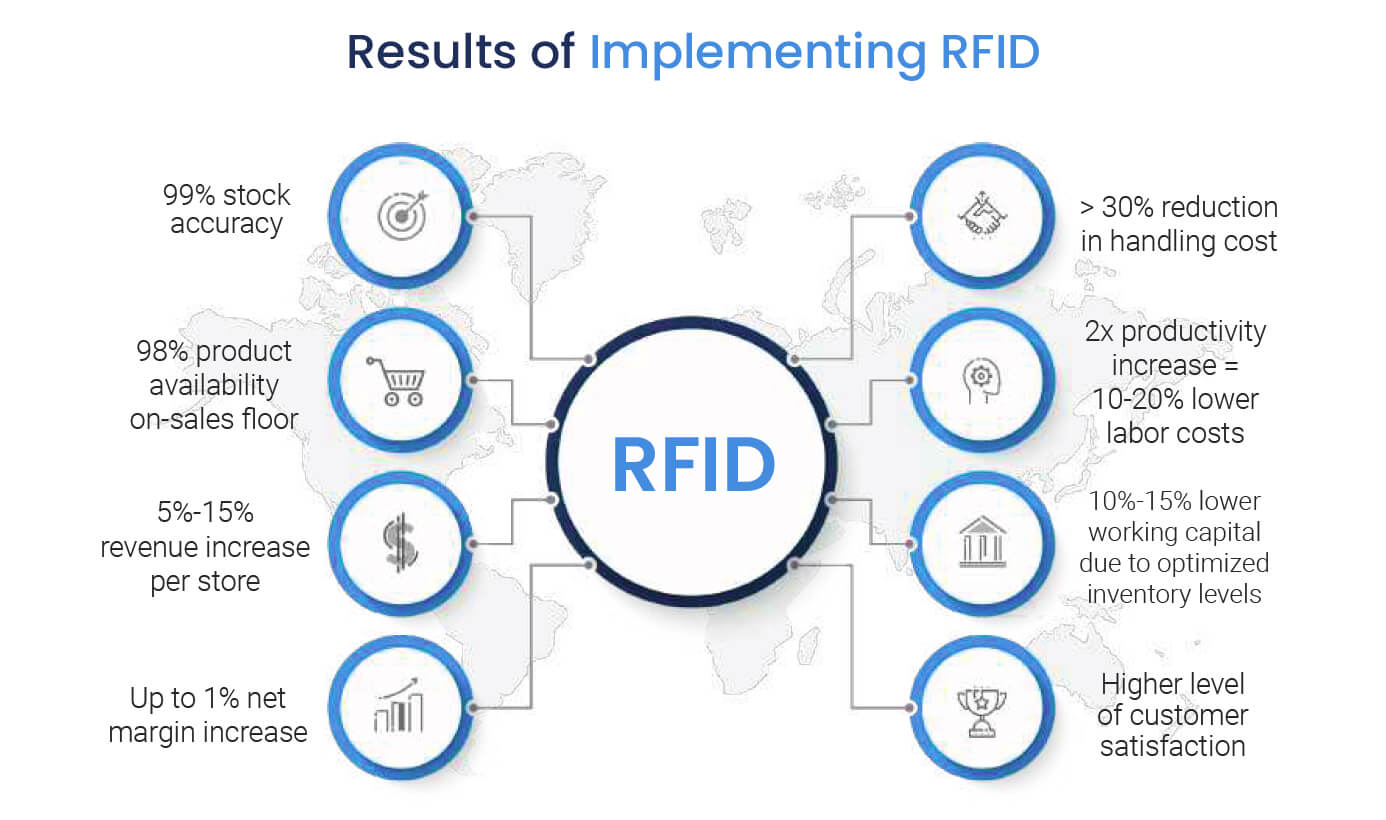

As the industry recovers, retailers pursuing digital transformation in order to optimize operations, expand omnichannel fulfilment, and enable data-driven decisions are poised to lead the way. One of the foundational technologies providing insight to drive digital transformation? RFID.

Beauty retail is an industry at a crossroads. A sector resilient to crisis and change compared to other retail categories, cosmetic brands are beginning to feel the effects of the pandemic and ongoing industry changes.

In recent years, apparel and sports retailers have undergone digital transformations to stay competitive, and now beauty brands have an opportunity to follow suit. Read this eBook to discover how and why beauty retailing is set to transform into the industry of the future.

Beauty retail: An industry at a Crossroads

The apparel and sports retail industry have undergone mass change over recent years. Such retailers have undertaken digital transformation journeys in their store and distribution networks to adapt to digital-first customers and eCommerce competition. The beauty sector, however, is still behind the curve.

In most major beauty-industry markets, in-store shopping accounted for up to 85 per cent of beauty product purchases before the COVID-19 crisis – (McKinsey&Co) making the level of eCommerce penetration lower than in other retail sectors. While retailers in other categories have been forced to innovate and adapt in the face of falling brick-and-mortar sales, competition from eCommerce and direct-to-consumer models, brick-and-mortar beauty sales were more resilient.

But this is changing. Not only are eCommerce levels steadily increasing year-on-year, but the COVID-19 pandemic has accelerated this drastically, driving five years of change in a single year, according to

IBM. This leaves brick-and-mortar beauty retailers on unsteady ground. Beyond this, brands will have to navigate a more digital-centric environment and optimise margins to cope with reduced sales.

The good news is many of the challenges that are now facing beauty have been facing apparel or CPG for years. The digital solutions and strategies that have allowed apparel to adapt are well established and ready to deploy to the sector. The digital transformations that many apparel and sports retailers were forced to undergo will not only fit beauty retailers but will also help them solve older challenges. Beauty retailers may need to go on a similar journey to apparel, but the tracks are there to follow.

What is in the eBook?

- Beauty retailing at a crossroads

- Bringing beauty operations up-to-speed

- Accuracy redefining margins

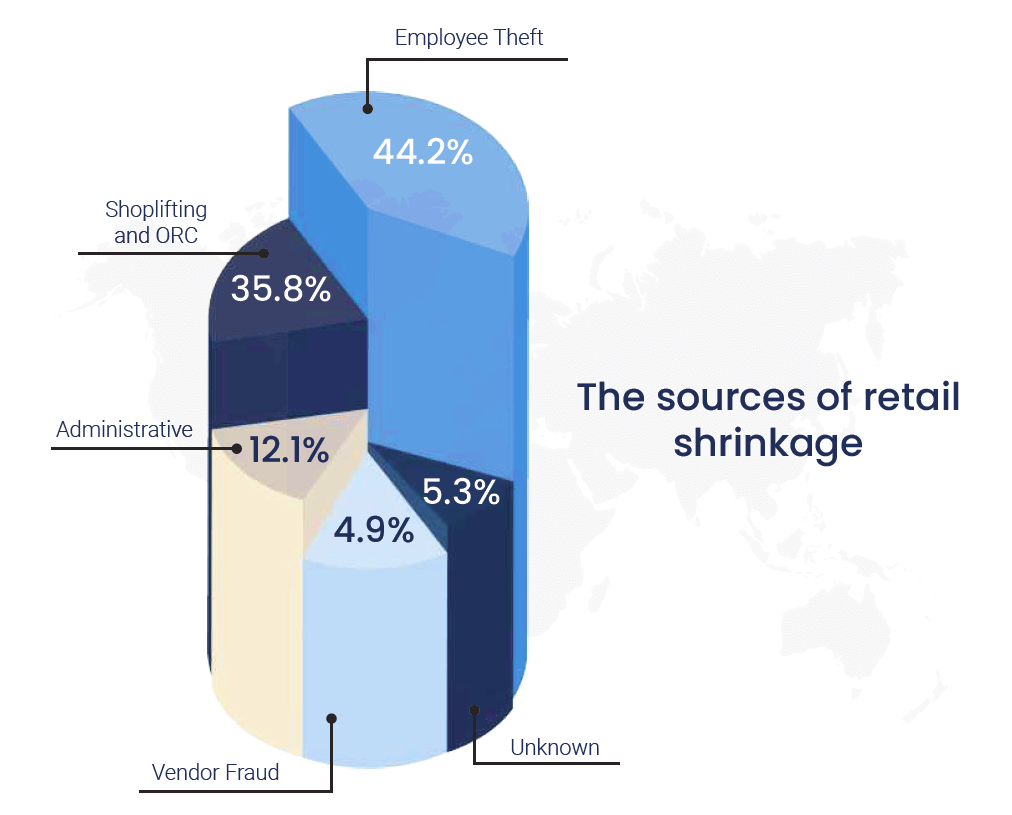

- Fixing beauty’s shrinkage problem

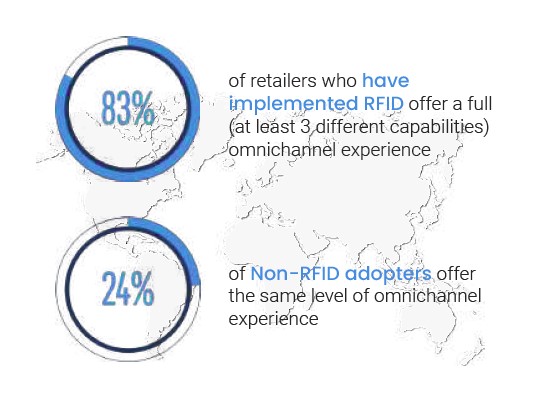

- Catching up with the omnichannel trend

- Countering the Gray Market

- Becoming digital and analytics leaders

Discover how retail RFID is changing the industry for good. This eBook will guide you through the top 10 needs identified by retailers to ensure sustainable success in the modern environment. Explore the common challenges preventing retailers from achieving their goals and learn how applying smart RFID-based solutions delivers consistently good results.

What is in the eBook?

The retail industry is currently ruled by change. The digital age has seen a huge growth in competition from e-commerce and a rapid shift in consumer preferences. This shift has altered the industry greatly with modern ‘omnichannel’ customers demanding to shop where they want, how they want and when they want. Delivering such an experience is a challenge, one that requires brick-and-mortar retailers to change.

In this eBook, we analyse the top 10 needs identified by retailers to ensure sustainable success in the modern environment. Within each of these needs, we identify the challenges often preventing retailers from achieving them, and how applying smart RFID-based solutions can deliver consistently good results.

Improving key metrics in stores

- How retailers use RFID for quick and efficient stocktakes and cycle counts

- Improving stock accuracy in stores

- How smart solutions are being put to use for item-level replenishment, ensuring products and sizes are always available to be sold.

Delivering to customers with retail RFID

- How stores can reduce common customer friction points

- The relationship between RFID and effective omnichannel services

- The advanced retail RFID solutions that improve the in-store customer experience like chatbots and smart fitting rooms.

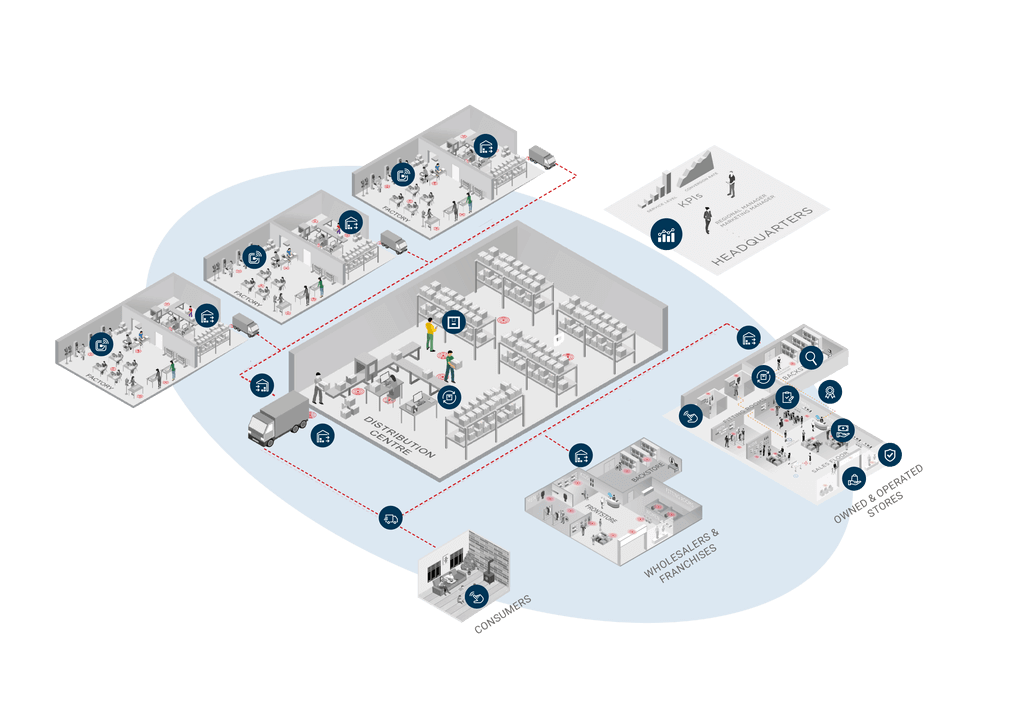

Optimising supply chains from source to store with automated processes

- How to achieve supply chain visibility with real-time info on the movement of products inside and across individual stores and distribution stages.

- How RFID is used to aid logistics at distribution centres, including automated processes like exception handling and order picking.

- What RFID means for retailers’ data and analytics capabilities, such as advanced supply chain traceability and new KPIs for stores and DC’s.

Protecting brands and products from theft, counterfeits and the grey market.

- How RFID can be used to monitor and reduce shrinkage, including theft, both in stores and across the entire supply chain.

- How brands are combatting counterfeit goods by tagging and tracing their products with RFID.

- What the Grey Market means for retail and how several major brands use RFID traceability to locate and stop the source of grey market products.

Managing the flow of merchandise in retail supply chains has always been a challenge.

Traditionally, the large quantities being dealt with meant that visibility of merchandise was poor. Items were tracked and accounted for in rough quantities, not consistently or accurately enough to hold suppliers and distribution centres accountable for mistakes and inaccuracies. This meant a fair amount of leakage, either of efficiency or directly in the form of physical shrinkage as items become ‘lost’, damaged or shipped incorrectly.

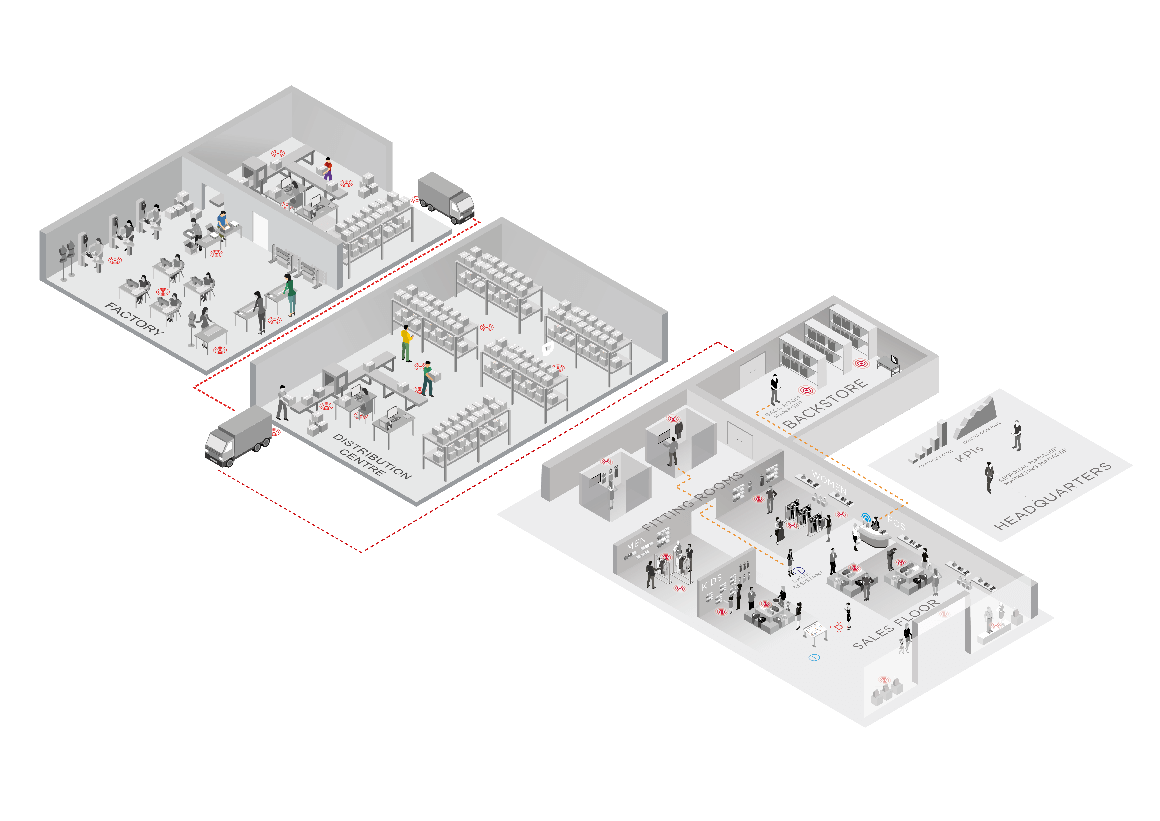

Fast forward to the present day, with advanced technology like RFID and the IoT, and the standard for retail supply chain management has changed. ‘Supply chain 4.0’ can effectively track and trace individual items from source to store, utilising RFID technology to track individual products and the Internet of Things to store and leverage this information on a digital platform or cloud.

The data and visibility provided by such digital supply chains are extremely valuable, allowing retailers to:

●Quantify the performance of the supply chain (visibility),

●Identify “the last known location of items” (accountability),

●Inspect the history of items and even raw materials (traceability).

Here are the 3 fundamentals of retail supply chain optimisation using item-level data:

Visibility

“To be able to see…”

Supply chain visibility is a growing priority for retailers. According to a report by Zebra Technologies, 72% of retailers are working on digitizing their supply chains in order to achieve real-time visibility. Knowing exactly what is in the pipeline allows retailers to control inventory more efficiently, improve operations between stores and DC’s as well as offer effective omnichannel services and delivery options.

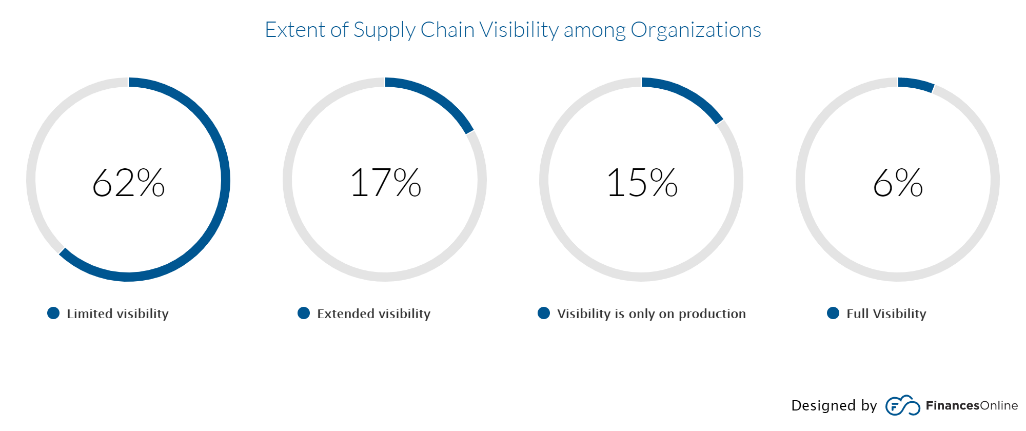

However, the majority of supply chains don’t have anywhere near this level of visibility, as 62% of supply chains operate with a limited view over merchandise flow. This is because goods move along the supply chain in such large quantities, and most supply chains only account for cartons of items, rather than the items themselves.

For example, cartons of T-Shirts with quantities of around 50 are commonly sent out, but without RFID accounting for individual products, you can’t know if the quantities are correct. In other words, you are guessing what should be there as you do not have the visibility to know what is there. This may result in a store believing they have less or more products than they actually do. If however, they do identify the mistake, without visibility over the supply chain there is no way of knowing where the error occurred.

RFID technology can make every step along the supply chain visible while also providing a meaningful context, using digital ‘touchpoints’ to track items throughout their journey. RFID Tunnel installations can even automatically process these cartons, to identify shortages and surpluses all without opening the box. This way large inbound and outbound shipments can be processed quickly, accurately and down to the item-level.

Traceability

“To be able to verify the history…”

If supply chain visibility allows us to know where items are right now, traceability means being able to look back at where they have come from. As items are tracked through the supply chain with RFID, a record of all read events is stored on the cloud. Not only this, but the data from the product journey can be combined with similar data from materials used in each product. This information means retailers can not only see the last locations and events of items but they can also:

- Inspect their history (inception to sale)

- Change layers of abstraction (e.g., from item to carton)

- Go back to the source (materials sourced from cotton farms)

Having the ability to trace individual items back through the supply chain allows retailers to identify where shrinkage occurs and trace products back to the source in the case of a product recall. The traceability is also key as it involves keeping a permanent record of supply chain flow, not only does this mean valuable data, it also gives supply chain leaders the concrete evidence to hold suppliers accountable…

Accountability

“To be responsible…”

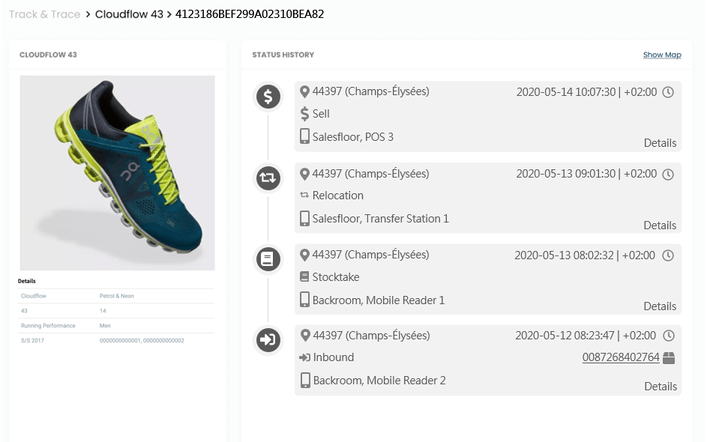

With digital track and trace technology in place, retailers will have access to the all-important last known location of items.

This means it is possible to identify where errors occur and hold supply chain and retail partners accountable. On the other hand, it can also serve as proof of service.

This information is also invaluable when it comes to brand protection. Not only can RFID technology easily identify counterfeit products but using the last known location of products allows retailers to identify how legitimate products end up on the grey-market. This is achieved by tracing them back to their last known location in the supply chain.

Knowledge of when and where an item was last seen/did not show up also dramatically speeds up clarification and accountability processes.

These 3 building blocks allow the extraction of KPIs and models to:

- Monitor shrinkage

- Identify grey imports

- Minimize counterfeits

- Automate re-ordering via dwell times and throughput

- Identify bottlenecks.

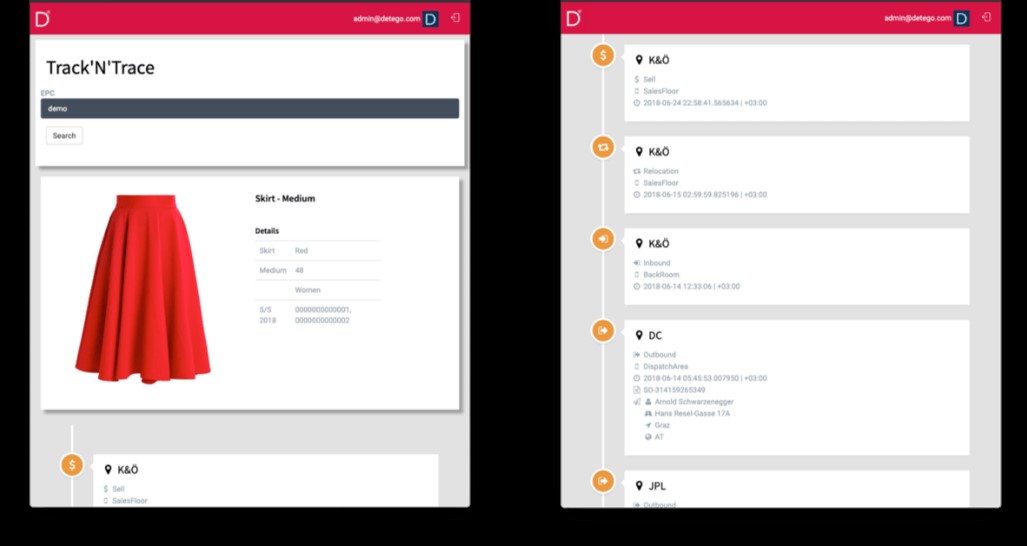

Looking to optimise your retail supply chain? The Detego platform is the end-to-end track and trace solution

Achieving complete supply chain transparency requires implementing an RFID system across your entire value chain, preserving detailed information about each RFID read event of each individual item (such as inbound verification, stocktake or sale). Thanks to that, knowing an item’s EPC (Electronic Product Code) number is enough to find out what, where and when happened to it. This capability is most useful when stores, distribution centres and factories are all integrated with one system – that system is Detego.

With efficient RFID processes from source-to-store, retailers not only gain new levels of accuracy and efficiency but achieve unprecedented transparency of the supply chain. Detego’s Global Track and Trace feature deliver the visibility, traceability and accountability to optimise retail supply chains for sustainable retail success.

Apparel Retail’s New Normal: COVID-19 Impact and Future Trends

16th June 4 pm BST / 11 am EDT

As apparel retail begins to get back to its feet, how are retailers preparing in the short-term, and what lasting effects will there be? The pandemic will cause the rapid acceleration of ongoing changes in the industry, and entirely new ones that could never have been expected.

Now stores are facing new social distancing guidelines, the formula for customer experience has changed. With reduced foot traffic and higher levels of eCommerce, the digital evolution of the retail store is now or never. Join us on the 16th of June as we dive into the physical and digital transformations behind retail’s ‘new normal’.

This webinar will cover:

- The impact of the COVID-19 crisis on the apparel retail industry

- How retailers are adapting retail stores to social distancing measures

- How a shift in the balance between eCommerce and brick-and-mortar is driving retailers to adopt digital-enabled stores

- How retailers can utilise digital and analytics to optimise operations and solve key challenges

Data by nature: Why eCommerce analytics are steps ahead

Online retailing not only created a new way of shopping, but it also changed the game when it comes to tracking and analysing the shopping journey. There is almost nothing that is not being evaluated while surfing the webshop. Digital-heat-maps of individual online sessions are analysed, showing every click and scroll through the online store. Every possible KPI is monitored: Conversion rate, click-through rate, average order value, the relation between new and returning visitors, bounce rate and retention to name a few. The really powerful thing about this is that analysis is always followed by action, to improve both the effectiveness of the webshop and the experience of its customers.

Data by design? Time for brick and mortar to take some lessons

Naturally, eCommerce has a significant advantage when it comes to analytics, a digital channel is always going to produce more data. Brick-and-mortar stores need to adapt to compete however, and technology is trying to bridge this gap between the physical and digital. Some of the more hardware-heavy options include AI-powered cameras, smart shelves or even aisle-roaming robots.

While hardware-intensive solutions like customer-tracking smart cameras are available, with the right software supporting it, a technology that simply tracks products (such as RFID) and leverages the IoT (Internet of Things) can revolutionise analytics for stores. These technologies and their supporting platforms are a big driver of ‘Digital transformation’ which delivers the analytics and data that brick-and-mortar stores are desperate for.

Here are 3 lessons from eCommerce for improving analytics in retail stores….

The need for real-time data

For years, brick-and-mortar retailers have been complaining about imprecise stock-figures and unreliable historical data. Unhappy with its purchasing decisions based on last year’s sales figures, retailers would prefer to have real-time data and inventories that allow for reliable and economically viable decisions. After all, it is important to avoid high-security stocks in order to reduce capital tie-up.

But why do we actually have this problem? Are the data points offered by the ERP systems not enough? Unfortunately not – it is not unusual that the ERP system shows higher stock than actually available on the sales floor. This so-called “ghost stock” is the cause for various problems in sales, e.g. the ERP system says a certain article, for example, a red skirt in size S, is in stock, but in reality, it is not. It can neither be sold nor refilled from the central warehouse – a classical out-of-stock situation. Or vice-versa, the ERP displays a lower inventory level than is actually available. The reason for these deviations is insufficient accuracy in individual processes that dangerously sum up over time.

Today’s intelligent article management is based on three pillars: fast, RFID-based article identification on item-level, tracking of every movement in real-time and proactive analysis with concrete recommendations for actions to take for the sales personnel. This is the foundation for optimum customer service and efficient processes.

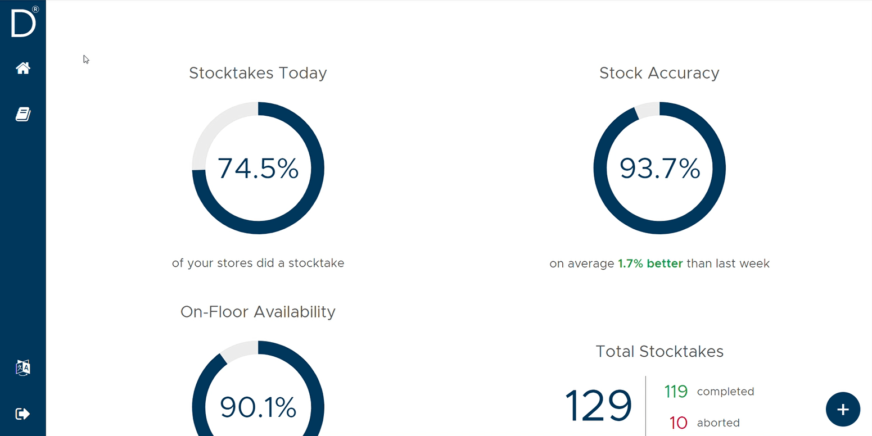

What does real-time data mean for Brick and Mortar Stores?

- High Stock accuracy

- Increases product availability of the shop floor from accurate replenishment

- Allows for convenient omnichannel services like click-and-collect

- Equips store staff with up-to-the-minute stock information – allowing them to assist customers better

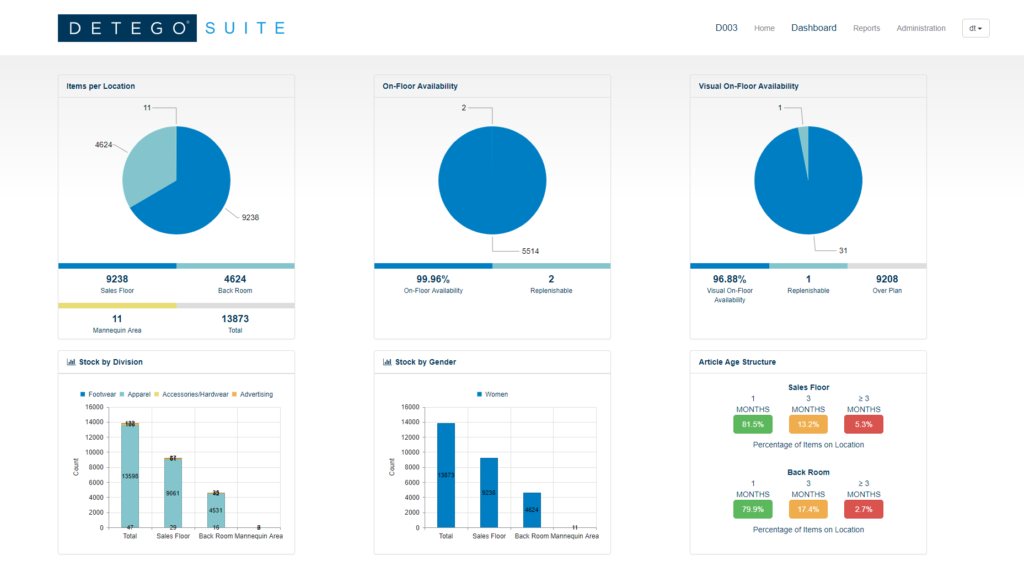

Meaningful KPIs in the store

When measuring KPIs, the practical benefits for retailers are paramount. Three areas of data in the store can be distinguished:

KPIs for Store performance

Inventory Accuracy

Whether five or 800 stores, KPIs for measuring inventory accuracy are significant for every retailer and still represent one of the main challenges in today’s business. Retailers, on average, can actually make accurate statements on just about 75% of their inventory (based on SKU level). However, this is not enough to meet customers’ expectations for omnichannel services. Therefore, inventory transparency and corresponding KPIs are essential for retailers´ success.

Product availability

Product availability on the sales floor, also known as on-floor availability, is the second central parameter. Initially, it is less about the exact position and more about the fact that the articles are on the sales floor – after all, only items that are actually available can be sold. This key figure can be combined with an alert system that makes sure not to fall short of the defined minimum availability. Complementary to classical ERP-systems, RFID-based merchandise management takes the data granularity to the next level, by knowing exactly at each moment in time if products are really on the salesfloor or still lingering in the backroom of a store.

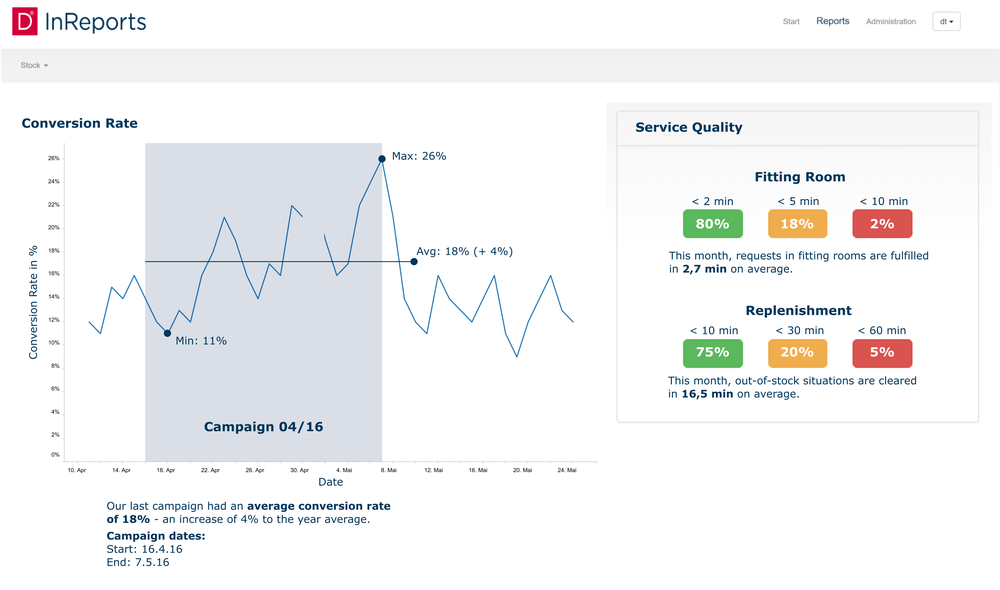

KPIs for individual product & campaign performance

Product dwell-time on salesfloor

Having data on item level, store managers are also given important information on the dwell times of articles on the sales floor. This information is more valuable than simple sales data, as it tells us the average time individual products spend on the sales floor before being sold. This can be used to gauge whether products are performing & corresponding with the sales plan. Common recommendations made from this data include moving items do a different location on the salesfloor (i.e. adjusting the planogram) or relocating excess inventory to another store – both of these measures reduce profit-sapping inventory bloat and end-of-season markdowns.

Fitting room conversion rate

One of the most famous KPIs in e-commerce is the conversion rate that describes the ratio between purchases and website visitors and also provides information on certain items that were already in the shopping cart, but for some reason have not been purchased in the end. Specifically, this aspect was incredibly difficult to measure in the store for a long time but can now be measured in fitting rooms using IoT and RFID technologies. This provides meaningful insights into how many, and above all, which articles does a customer take into the fitting room and which one does she/he actually buy?

KPIs on customer engagement and service quality

On an operational side, KPIs can also be used to manage service quality. We’ve already covered product-availability and stock accuracy, which affect the customer just as much as the store with out-of-stocks or unavailable sizes being all-too-common pain points. The replenishment rate provides another angle to combat this, as it shows how quickly articles are replenished on the sales floor. On the other hand, the fitting room response time describes how quickly sales personnel handle customer requests coming from the fitting room. The KPI “Conversion rate per campaign” shows the success of a campaign and if campaign-specific countermeasures are necessary.

Turning data into actions

The final lesson brick-and-mortar retail should learn from the webshop? Turning data into actions. Since nobody needs a data graveyard, any analysis needs the goal of creating immediate actions to improve. Today’s systems help the management team as well as the store personnel with concrete and automated recommendations for actions to take. This saves time in the decision-making process, unburdens the sales personnel, and enables them to do the right things at the right time.

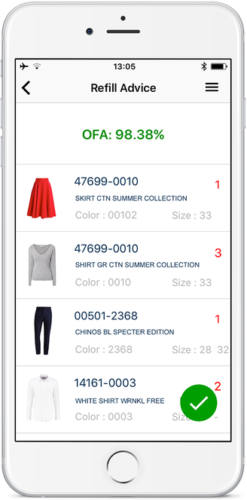

KPIs should be suitable for everyday business use. Presented visually and self-explanatory, they need to be linked to clear recommendations for actions to take. This frees up store personnel time and provides a data-driven way of optimization. Examples range from simple in-store replenishment advice, i.e. “The minimum stock for article #47699-0010 has been reached – please refill three pieces” to more advanced topics, e.g. to choose a different placement in the store for a specific article when the dwell time on the sales floor is too high compared to other stores. Advanced systems can even utilise AI and Machine learning to automate and refine certain processes, like adjusting store planograms and creating optimal pick paths when replenishing stock.

Conclusion

Brick-and-mortar retail needs support and an update to the toolbox when it comes to analysis and measures. Not only does the sales personnel benefit from intelligent recommendations for action, but the management team also gains efficient control mechanisms across the entire store network. Decisions are made based on real-time data and therefore allow timely action. Ultimately, the end customer is pleased about a first-class service, which – thanks to the individual and informed advice through the sales personnel – even exceeds the standards of the online retail.

Webinar

Item-level Reporting from

Source-to-Store

Register for this webinar where we outline the impact of digitisation on supply chain analytics and operational efficiency. Covering the wealth of item-level data unlocked by RFID, the presentation will explain the new KPI’s available for modern supply chains and their impact on retail operations.

Webinar: Item-level reporting from source-to store

Digitisation and data go hand-in-hand. As retail supply chains continue to go digital, a wealth of item-level data on the flow of merchandise through the supply chain is unlocked. In the future, the winners and losers of supply chain management will be determined by who leverages this information more effectively.

Join Detego’s Chief Data Scientist, Simon Walk, as he presents the cutting edge of supply chain analytics and how digitisation is taking the guesswork out of retail logistics.

This webinar covers:

• Item-level tracking of Items along the Supply Chain to deliver accountability, visibility & traceability

• Effective traceability which combats supply chain shrinkage and counterfeit products.

• Using heuristic & Machine Learning based Algorithms to detect supply chain irregularities.

• Using dwell-time data to optimise operational & Supply Chain processes

• Analysing throughput data across factories, DCs and stores

Complete Supply chain visibility was once an optional bonus for retailers, but in the modern industry it is becoming more and more of a necessity.

Whilst in the past, limited tracking of shipments in the supply chain was commonplace, in the modern environment with its more complex supply chains, delivery options and increasing customer expectations, retailers need to do more.

This isn’t just us saying so, retailers recognise this too. According to a report by Zebra Technologies, 72% of retailers are working on digitizing their supply chains in order to achieve real-time visibility.

What Is Supply Chain Visibility?

Having visibility means being able to accurately track products and shipments throughout the supply chain, from the manufacturer, to the distribution centre and finally to the store. Having this visibility prevents shipping errors, improves operational efficiency and allows retailers to leverage products to service their customers better.

Why Do Retailers Need Visibility?

Managing supply chains effectively is always a priority for retailers. But as these supply chains get bigger the challenge becomes more daunting. Visibility is needed to align such large operations, and this is before you add new pressures like omnichannel, traceability and online orders.

Additionally, supply chain visibility is arguably even more important in ecommerce than for pure-play brick and mortar retailers. Not only do you need to know exactly what stock the fulfilment centre has, but what stock it is due to receive and when. And since pure-play brick and mortar retailers are now few and far between , this now means that most retailers’ supply chains need to be more advanced and transparent than previously required.

This is before mentioning the divisive omnichannel word, which often requires even greater transparency and synergy between stores and distribution centres and includes multiple delivery options.

There are also more classic supply chain challenges that can be helped by achieving visibility. General inefficiencies and inaccuracies can be reduced by adding more checkpoints throughout the supply chain – particularly when these are done at an item level, and not shipment or carton level.

Adding this visibility also makes better communication between different stages of the chain possible, which leads to smoother operations. Having visibility at an item-level also makes traceability of items through the supply chain possible. This can make a massive difference in combatting supply chain shrinkage, and in some cases the grey market.

The ‘New’ Challenges:

Multi/omni-channel businesses – It seems like an age ago, but traditional retail supply chains went in one direction and to one place – stores. Now almost all retailers also run their businesses online meaning their they operate on multiple sales channels, therefore, their supply chains service far more destinations than before.

Multiple delivery options – A relatively recent challenge created by the growth of online and the already mentioned omnichannel purchasing options. Retailers want to offer their customers as much stock and as many purchasing options as possible, but without the technology to support it, this can cause problems. In an Accenture survey, respondents claimed that 31 percent of their Ship from Store orders triggered a split shipment.

Customer expectations – Customer expectations has shifted. In a 2019 report, it was found that Half of shoppers reported abandoning a purchase due to a lack of cross-channel buying options. This is a major impact on sales, and many retailers are starting to adapt to the change in expectations.

The Old Challenges:

Supply chain inefficiency – Supply chain inefficiencies and miscommunication through “Chinese Whispers” are costing UK businesses over £1.5bn in lost productivity according to analysis of industry data from Zencargo.

Supply chain shrinkage – According to the National Security Survey, businesses in the United States lose $45.2 billion through inventory shrinkage a year. Whilst retail stores make up the majority of this, supply chains still experience large amounts of inventory shrink, particularly when they have no visibility of products.

What are the benefits of having supply chain visibility?

-

Better customer service

-

Improved inventory control

-

Shorter cycle times

-

Smoother operational processes between stores and DC’s

-

Better data for more intelligent business decisions

-

Reduce out of stocks

-

Track and trace products

-

Offer effective omnichannel services and delivery options

How Do You Achieve Supply Chain Visibility?

-

Implement a system that works at an item-level (not whole cartons)

-

Accurately track products at as many points as possible during shipping

-

Inbound and outbound counts at every stage of shipping

-

Implement effective exception handling

-

Use a cloud-based system to integrate all stages of the supply chain and achieve as close to a real-time view of merchandise movement as possible

-

Send advanced shipping notices (ASN’s) so warehouses and stores now exactly what they’ll receive

-

Use this visibility to enable traceability of each item throughout its journey

The Detego Platform allows retailers to gain complete visibility over their operations

If you’re looking for a solution or partner to help achieve better supply chain visibility, consider our platform!

Using RFID item level-tagging, the cloud-based Detego platform gives each individual item a unique digital identity. Items are then tracked from factory to shop floor using radio frequency identification (RFID) methods. RFID makes this possible as inbound, outbound and even exception handling can then be done through RFID reads – which are fast, accurate and can be done without opening cartons.

Since RFID works on the individual item-level, the result of this is complete visibility of the supply chain. The platform utilises the IoT to create a complete overview of every single product in the supply chain, as its cloud hosted this can be close to real-time and is the ‘single point of truth’ for the entire business.

Want the latest retail and retail tech insights directly to your inbox?

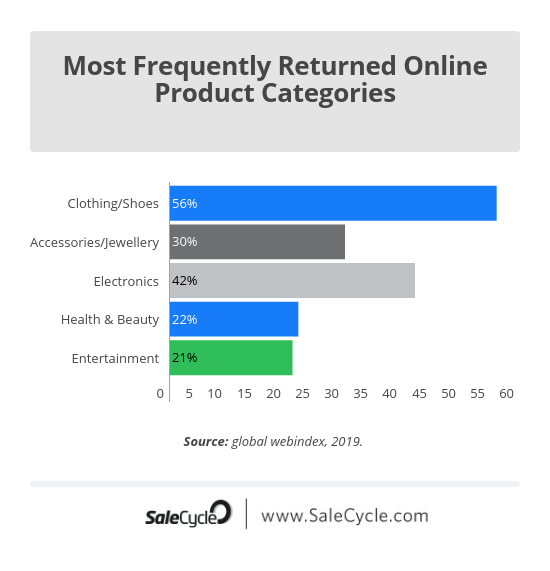

Online returns have been a challenge for retailers since the beginning of eCommerce. This is because of both their volume compared to normal stores, and the costs associated with processing them. In the wake of COVID-19, this problem could prove more critical then ever, as online becomes retailers’ singular sales channel. There is already early evidence of this, with preliminary data from Quantum Metric showing that eCommerce associated with Brick and Mortar retailers saw an average revenue weekly growth rate increase of 52%, and Nike Inc.’s digital sales went up by 36%.

The eCommerce returns dilemma

Online shopping is popular for a reason, but the convenience and choice of eCommerce comes at the price of not being able to ‘try before you buy’ for customers.

This simple difference is the reason online returns are so much more prevalent than for Brick and Mortar stores. In eCommerce the customers’ homes becomes the fitting room. And, just like any fitting room, products end up back on the shelves. According to Happy Returns, while shoppers return only 10% of what they buy in stores, they send back up to 50% of what they buy online.

This is compounded by customers accounting for this when ordering online. A survey from Barclays found that 30% of shoppers deliberately over-purchase and subsequently return unwanted items. Additionally, 20% regularly order multiple versions (often sizes) of the same item so they could make their mind up when they are delivered, all of which is facilitated by the retailer at great cost.

While it might seem logical to have stricter returns policies, or make customers cover the cost of returns, consumer expectations make this a risky strategy. According to the 2017 UPS Pulse of the Online Shopper survey, 68% of shoppers view returns policies before making a purchase. This leaves retailers with a catch-22 situation when it comes to losing out on online sales or losing profits from processing the inevitable returns that comes with those sales.

What are the challenges of retail returns?

So why are returns such a strain on retailers?

Cost of returns – First and foremost is the simple cost of returns. Since returns are in themselves essentially lost sales, the added cost of returning them, which according to CNBC is on average 30% of the purchase price, can heavily impact retailer’s margins.

Processing returns and reverse logistics – On top of this is the resources and effort of processing returns and getting the stock back available to be sold as quickly as possible. This reverse logistics can be particularly challenging and can result in returned stock not being available for purchase again for some time, often leading to out-of-stocks on the webshop. According to the Barclays report, 57% of retailers say that dealing with returns has a negative impact on the day-to-day running of their business.

Contamination concerns with COVID-19? – A unique and recent challenge, particularly for apparel retailers, is dealing with the potential contamination and contact of returned good with the COVID-19 virus. Initial research suggests that the virus can only survive on fabric surfaces for 24 hours, but for up to 72 on plastics like packaging. This will need to be addressed by eCommerce retailers who continue trading throughout the epidemic.

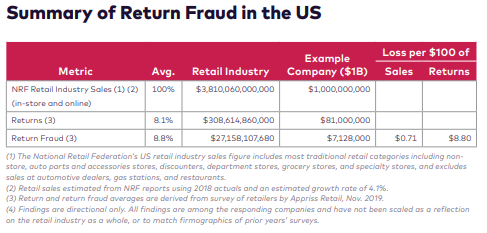

Return fraud – This is a challenge shared by brick-and-mortar stores. Fraudulent returns cost the US alone 27 billion dollars a year. This can involve the ‘returning’ of stolen merchandise for cash, stealing receipts to enable a false return or using someone else’s receipt to return unpurchased store stock. Naturally, using receipts for returns presents a risk, APPRISS found that receipted returns are more than twice as likely to be fraudulent as other methods.

How to reduce the impact of returns on eCommerce

So what options are there for retailers looking to tackle their returns problems?

- Reduce the likelihood of returns, without harming customer experience or sales: Include accurate and detailed product descriptions. Use uniformed/standard sizes where possible and provide a more specific sizing filter. Offer virtual ‘try-ons’ with augmented reality/3D imaging.

- Set clear and accessible rules regarding returns: Make sure customers know what and how they are allowed to return items, this reduces spending resources processing illegitimate returns.

- Improve visibility: Maintain a single view of stock with item-level inbound and outbound processes, this will also allow for online returns back to stores, and ship-from-store. Make this visibility accessible to your entire team and your customers.

- Improve efficiency of inbound and outbound processes: Utilise reliable & efficient technologies and automated processes like exception handling. One of the leading technologies for this is RFID, which prevents the need to open any boxes or packages as it can count and verify items without direct line of sight.

- Improve internal processes: Ensure returns processes (and supporting software) enables additional layers of merchandise management such as grading items based on quality and tracking when the item was returned.

- Counter Return Fraud: Verify legitimacy of returns as much as possible, best practise involves unique item-level validation like RFID or unique serial numbers.

- Ensure returned stock is safe to sell: Implement processes to ensure returns are not damaged in any way, implement a policy to account for safe handling of merchandise during theCovid-19 pandemic, either sanitising products or leaving them a set amount of time before adding back into webshop stock.

Using RFID tagging and looking to improve return processes?

NEW: eCommerce returns module

eCommerce/ DTC is increasing due to COVID-19. This causes an over proportional increase in returns which normally would require a ramp up of staff and equipment to handle the process – Detego’s new RFID enabled return process provides an approx 90% productivity increase.